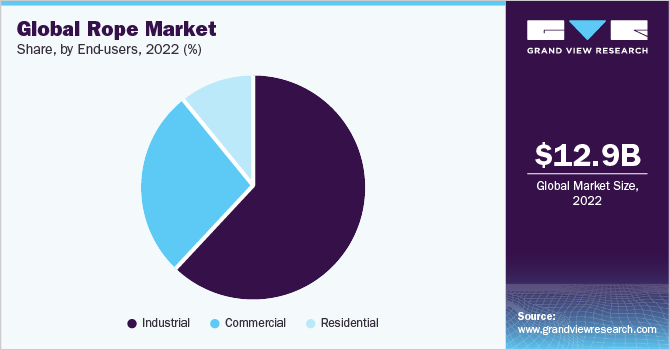

The global rope market size was valued at USD 12.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The growth of the global market is mainly driven by the rising demand for ropes for residential and commercial purposes to weigh loads and materials. With the rising population, the demand for residential housing units is expected to grow exponentially. Consequently, the demand for wire and synthetic rope is expected to increase. According to World Population Prospects published by the United Nations, the world population is projected to reach 9.8 billion in 2050 and 11.2 billion in 2100.

The global outbreak of the COVID-19 pandemic created a global health crisis and disrupted all industries, including engineering and construction industries across the globe. The construction and engineering industry, one of the major users of rope products, took a major hit, which further reduced product demand among companies. According to statistics published by The World Bank, the global construction sector contracted by 3.1% in 2020, its largest decline since the global financial crisis of 2008. However, in the coming years, the global rope industry is expected to witness strong growth with the advent of advancements in materials technology and manufacturing innovations. Additionally, the growth of the real estate and construction industry is expected to positively impact the global market and increase the rope demand for regular purposes.

Moreover, the increased spending on construction and mining equipment is driving the growth of the global market. Key rope manufacturers are heavily investing in advanced manufacturing technologies and materials to stay ahead of the competition. For instance, Teufelberger, one of the leading rope manufacturing companies, is heavily investing in the development of its ropes. The company is conducting intensive research to transform its rope portfolio to include rope robots, 3D printers, and automation. It is also modifying its product line to satisfy highly specific requirements while acting as universal elements for the transfer of tensile forces.

Additionally, the increased demand from a variety of sectors, including industrial & crane, mining, transportation, and marine & fisheries, the rope industry is expanding steadily. However, severe limitations such as high prices, frequent preventive maintenance, and usual wear and tear are limiting the market growth. Additionally, owing to international trade and tariffs, the prices for raw materials required to manufacture ropes will also increase, subsequently pushing rope prices across the globe. This is expected to limit the demand for ropes among price-sensitive end-users and low-budget residential and industrial sites.

Apart from this, major product innovations and product launches by key players are expected to create brand awareness and help them increase consumer reach. The key players in the global market are making significant efforts to replace conventional raw materials with cutting-edge variants that are economical and have no adverse environmental impacts during the manufacturing process. For instance, in October 2021, Jogani Impex LLP (Jogani Reinforcement) launched poly-fiber 3S, a new generation of concrete fiber wire for crack-free and durable infrastructure for the construction and infrastructure industry in India. In the coming years, the global market is predicted to witness promising growth as a result of these important initiatives by manufacturers, which will allow them to reach untapped markets and diversify their product offerings.

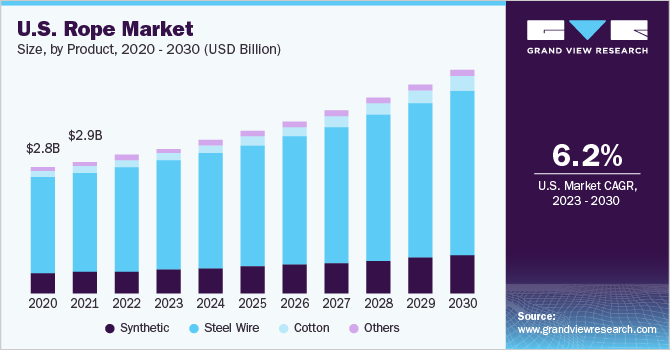

Steel wire dominated the product category with a share of more than 72% in 2022. A steel wire rope is frequently used in the construction, mining, oil and gas, and marine industries. It is made up of wires, strands, and a core made of steel and fiber. Steel wire ropes are created by twisting the wires, which are typically made up of stainless steel and high carbon steel. The rope’s function is to support and safeguard the external strands for effective functionality. Steel wire rope has a higher strength-to-weight ratio, which is an important factor for various applications, especially in the marine and fishing sectors. Such properties of steel wire will favor segment growth in the coming years.

Synthetic segment is expected to grow at the fastest CAGR of 7.7% in the forecast period. Synthetic ropes are made from man-made textile fibers that have been chemically infused and are used as a substitute for natural fibers. Moreover, due to characteristics like high strength-to-weight ratio, bend fatigue durability, and strong spooling capabilities, synthetic rope is also seeing increased use in cranes. Synthetic ropes have the extra benefit of being lighter than steel cables, which makes them a popular product in cranes and other maritime industry applications.

The industrial segment dominated the market with a share of over 60% in 2022. Ropes are widely used in many different industries, including construction, maritime and fishing, oil and gas, and mining, owing to lightweight, less downtime preparation, simple handling, and not requiring re-lubing properties. Moreover, synthetic ropes are one of the most often used forms of rope in the nautical and fishing industries. These ropes are offered in a variety of shapes and colors, and they help with excellent insulating capacity, chemical resistance, absorption prevention, and environmental resistance. Increase usage of rope for industrial application is likely favoring the market growth.

The commercial segment is estimated to grow with a CAGR of 7.3% over the forecast period. Commercial uses of ropes include camping, rock climbing, agriculture, adventure sports, logistics, and other applications. Ropes are a job site necessity that can be used for bundling, holding, and securing. In some cases, they can also be used for fall protection applications. The different types of rope used for commercial uses include nylon, polyester, hemp, and polypropylene.

Asia Pacific dominated the market with a share of around 45% in 2022. Rapidly expanding commercial and residential construction activities accelerate the need for waterproof and durable ropes that are lightweight and high in strength. The increasing infrastructural needs in emerging economies like India and China are driving the demand for synthetic ropes. Furthermore, China, South Korea, and India are major exporters of twine and rope across the world. In 2020, according to the Observatory of Economic Complexity (OEC), China, India, and South Korea accounted for more than 36% of the total export value. This is expected to propel the market growth over the forecast period.

Europe is expected to witness a CAGR of about 11% from 2023 to 2030. Increased demand for synthetic ropes is expected to result from increased marine and fishing business across European countries. Moreover, the growth in the construction industry is driving the demand for steel wire and synthetic rope. According to Europa, in January 2022 compared to January 2021 production in construction increased by 4.1% in euro area and 4.8% in the EU. In addition, the growing DIY interior decoration and home improvement projects across Germany have increased usage of the hemp rope, synthetic rope, and jute rope.

The global rope market is characterized by the presence of a few established players and new entrants. Market players are focusing on marketing, product launches, and partnerships to compete effectively in this industry.

For instance, in June 2022, Bridon-Bekaert Ropes Group (BBRG) designed a compact multi-layer construction rope Dyform 36LR PI+, with an engineered extruded plastic that spans the rope core and the 18 outer strands.

For instance, in February 2022, Bridon-Bekaert Ropes Group (BBRG) acquired VisionTek Engineering Srl, an Italy-based engineering software, computer vision systems company, to expand its service offering to the customers. This acquisition was aimed at extending the digital capabilities and benefits of the service offering of BBRG.

Some of the key players operating in the global rope market include:

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global rope market based on product, end-users, and region.

Product Outlook (Revenue, USD Million, 2017 - 2030)

End-Users Outlook (Revenue, USD Million, 2017 - 2030)

Regional Outlook (Revenue, USD Million, 2017 - 2030)